A friend in need is a friend indeed. We generally approach our friends or close family members when we are in need of any financial help. We lend (or) borrow money based on mutual trust. Usually these types of loans (hand loans) are unsecured. In most cases, the terms and conditions of a loan are undefined. If the payback (repayment of loan) does not happen, the relationship between the two parties gets strained.

Is there any way to protect the interest of the two parties? Is there any legal document so that you can clearly define the terms and conditions of the loan?

There are two ways of doing this :

Let us understand more about – What are the things to keep in mind before lending money to a family member or a friend? , Why a Promissory Note is important? What is the difference between Promissory Note and Loan Agreement?

Promissory note is a written promise to pay a debt. It is a financial instrument, in which one party (maker or issuer) promises in writing to pay a determinate sum of money to the other (the lender) , either at a fixed, determinable future time or on demand of the payee subject to specific terms and conditions.

It is of different types-single/joint borrowers, payable on demand, payable in installments or as lump sum, interest-bearing and interest-free.

Things to keep in mind while writing a Promissory Note:

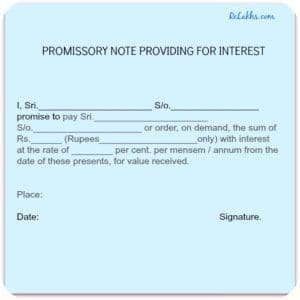

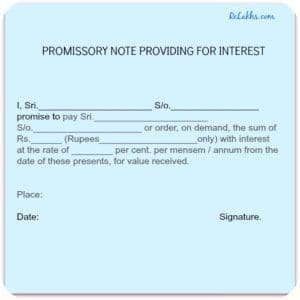

Sample Promissory Note Template :

Download Sample Promissory Note Templates for ” Sample Promissory Note where no time for payment is mentioned”, ” Template for Pro Note made by Joint Promisors”, “Draft P N where repayments are made in installments.”

What is a Loan Agreement?

A Promissory Note lies somewhere between the informality of an IOU (I Owe You) document and the rigidity of a Loan Agreement. An IOU document merely acknowledges that a LOAN exists. A Promissory Note not only acknowledges that there is a Loan but also includes a specific promise to pay.

A Loan Agreement ( Loan Contract) acknowledges that there is a loan, specific promise to pay and also states that the lender has a right to recourse (the legal right to demand compensation or payment) . Example can be a FORECLOSURE. If you want to have a right to recourse then go for Loan Agreement instead of a Promissory Note.

A simple Loan Agreement should include the following :

Loan Agreements are also popular with the financial institutions like Banks, Finance Companies, Gold Loan companies, Home loan (Mortgage) Lenders etc., You may have to generally submit Promissory Note and Loan Agreement to Financial institutions when you acquire loans from them. These loan agreements are very exhaustive and my run into tens of pages.

Simple Loan Agreement Sample / Template:

A Loan Agreement (LA) is like a Promissory Note (PN). A simple LA between two friends can be like a PN Note. But you can include Terms & Conditions especially regarding on the ‘event of default’ and ‘consequences of default.’ But the heading of the document should be clearly mentioned as “Loan Agreement.”

Tax Implications on Loans between Friends/relatives:

Interest free loans are not taxable in the hands of lender or borrower. But if you charge interest rate then interest earned on loan has to be treated as “Income from other sources.” This income should be shown in your (lender) Income Tax Return.

If you borrow money from your friend/relative (non-financial institutions) to construct a house, the repayments (installments) are not eligible for tax deductions. Tax deduction under Section 80c with respect to principal repayment is not allowed.

But Tax benefit under Section 24 of the Income Tax Act can be claimed as Tax deduction with respect to Interest paid on loan. The main criteria is ‘the loan should not be for personal use.’

My opinion on Lending money to Friends or relatives:

As Shakespeare wrote, “ For loan oft loses both itself and friend .” If you lend money to a friend or family member, beware that you may not get your money back and your relationship may never go back to normal.Think twice before lending money to a friend. Sometimes its better not to lend money to a friend keeping their best interests in mind.

If you decide to lend money, it is better to have an open and frank discussion about any potential problems or consequences with the loan. If you do not want to lend money, gently refuse the loan and identify the best alternate to help your friend or loved ones. (Read : ‘ 5 Personal Financial Mistakes that I have committed. ‘)

Would you like to add any suggestions or views on this topic? Please share your comments.

(FYI – RBI has issued a notification on 9th,Sep-2014 regarding ‘Guidelines on willful defaulters.‘ As per this, a guarantor of a willful defaulter can also be treated as a ‘Defaulter. So, think twice before accepting and signing as a guarantor for a loan)

( Image courtesy of anankkml at FreeDigitalPhotos.net)

Sreekanth is the Man behind ReLakhs.com. He is an Independent Certified Financial Planner (CFP), engaged in blogging & property consultancy for the last 13 years through his firm ReLakhs Financial Services . He is not associated with any Financial product / service provider. The main aim of his blog is to "help investors take informed financial decisions." "Please note that the views given in this Blog/Comments Section/Forum are clarifications meant for reference and guidance of the readers to explore further on the topics/queries raised and take informed decisions. The information provided, therefore, should not be viewed as financial, legal, accounting, tax or investment advice."