A young person is more likely to die due to an accident than by natural causes. A Term insurance plan covers the risk arising out of death. A health insurance plan can be beneficial if the insured gets hospitalized. What if an individual meets with an accident but survives with injuries (Total Permanent disability) ? This may lead to loss of income for months or even years. This is where a Personal Accident Insurance policy can be very essential.

Accident cover is available in many forms like – as an optional rider with a life insurance policy, as an add-on policy to your motor insurance or home insurance , as a group insurance cover from your employer , and as a standalone plan .

Most of the online term insurance plans do not provide Personal Accident insurance benefits. Some life insurance companies provide Personal accident death benefits as riders but do not provide risk cover for disability (Permanent or temporary) arising out of an accident. These optional riders are not as comprehensive as stand-alone Personal Accident Insurance Policies.

A PA insurance policy is a plan which provides monetary compensation in the event of bodily injuries or disability or death caused solely by violent, accidental, visible and external events. Personal accident schemes cover the policyholder against death or disability due to an accident.

The magnitude of the accident/mishap doesn’t matter, even minor accidents like falling off a bicycle and breaking an arm, or fracturing a leg while playing hockey are covered by a Personal Accident policy. The policy holder can claim insurance if he is disabled after an accident. Unfortunately if death happens due to an accident then the nominee of the policyholder can claim the sum assured.

A typical PA insurance plan provides;

Accidental Death Benefit – In case of a death due to accident, the PA policy would pay 100% Sum Assured to the nominee / beneficiary.

Total Permanent Disability (TPD) benefit – In case of TPD, the entire sum assured is generally paid to the policy holder. Some companies also pay more than the sum assured (like 125% of Sum assured is paid). Example – Loss of limbs or eyesight

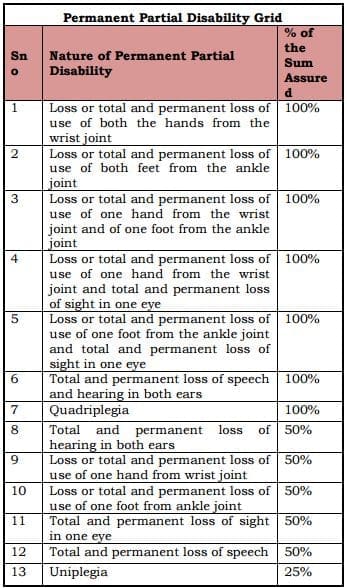

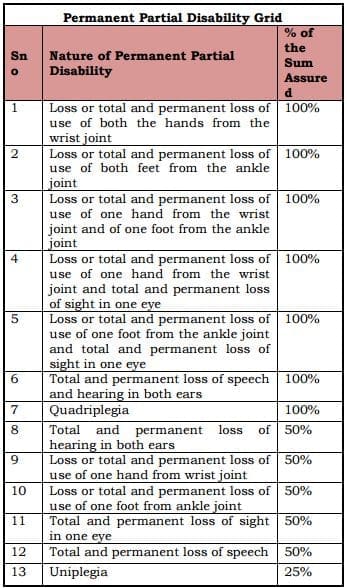

Permanent Partial Disability benefit – A percentage of sum assured (like say 10% of SA) is paid for a specific period of time or as a onetime payment (like 50% of SA) . Example – Loss of an eye or one limb, loss of one finger etc., The disability covered under PPD can be as a percentage of Sum Assured, for example as indicated below..

Temporary Partial / Total Disability benefit – This means that for some weeks or months an individual is totally disabled and will not be able to work and earn money. In such scenarios, the policy holder will be paid a percentage of sum assured like 20% of Sum assured or a fixed periodic payment for few weeks. Example – A fractured leg is a temporary disability, and if you have taken a cover against it, your policy will pay a weekly sum of say Rs 1,000 for up to 12 months.

(Be very clear about the definition of ‘disability’ before buying a personal accident policy. Read the fine print. Permanent total disability is defined as total loss of sight in both eyes, or total loss of use, or dismemberment of both hands or legs, or one hand and one leg. Losing one eye is a permanent, but not total disability. Ask the insurance company or agent to explain the exclusions clearly to you.)

Generally the premium of personal accident policy depends on the cover you select. It can be same across all the age groups but may vary depending on the type of employment or occupation you are in. Insurance companies categorize the various professions based on the level of risk associated with the jobs, working conditions etc.,

For example – Doctors, Software Engineers, bankers etc., fall under the category of low risk category. An individual who works in a coal mine can be offered a PA policy under high risk category and the company can charge higher premium.

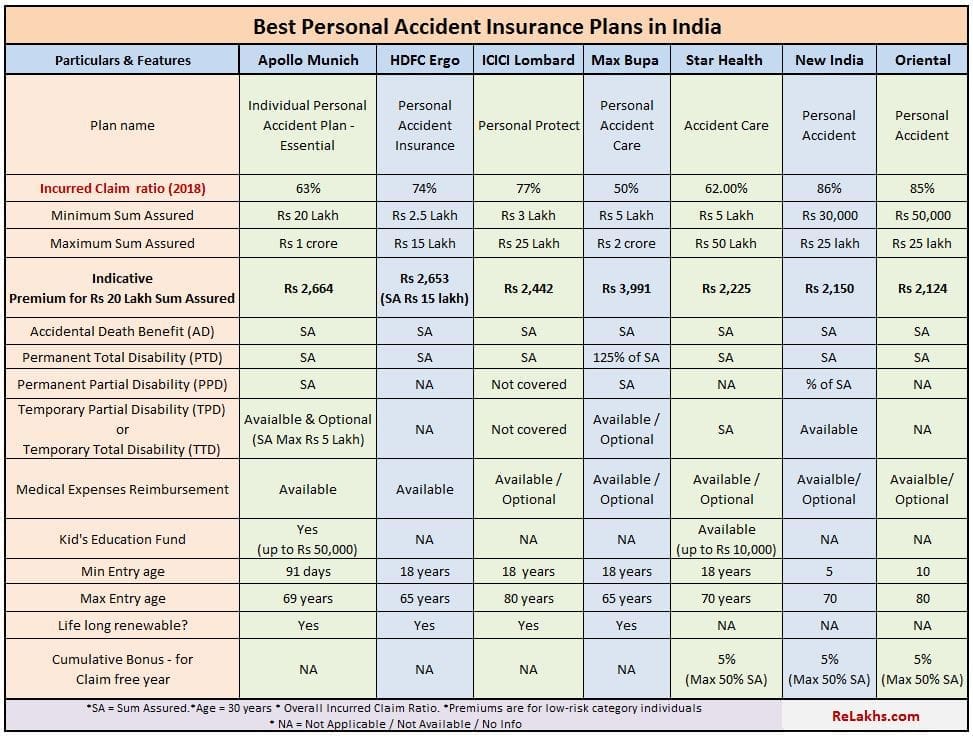

Below are some of the top and best Personal Accident Insurance Plans in India. The list includes insurance plans from;

(Click on the below image to open it in a new browser window)

In the event of Accidental injuries ;

In the event of an Accidental death , the following documents are required to be submitted by the nominee:

(The claim procedure or the required documents list may vary from one insurance company to insurance company and also on the type of claim.)

These days the probability of accidents is very high. Hence, it is advisable to have a comprehensive Personal Accident Insurance policy besides a term plan (buy a basic term plan) & a health insurance plan. Your PA policy should ideally cover Accidental death, Permanent Total Disability and Permanent Partial Disability. It is good to have Temporary Disability ( total/partial) and Medical Expenses also covered. Y ou can take a cover of up to 10 times your annual salary.

Since agents / advisers get very low commissions on Personal Accident Insurance Plans, they usually try to bundle the personal accident cover with some other insurance product (motor/home/life insurance) . But, it is better to buy a comprehensive and stand-alone PA cover. It is advisable to download and go through the prospectus, brochure, policy wordings documents before you buy a Personal Accident Insurance Policy.

Continue reading :

(Image courtesy of Chris Sharp at FreeDigitalPhotos.net)